Eskom price hike – here’s how you can save money

South Africans are bracing themselves for another substantial increase in electricity prices as a NERSA-approved 12.74% tariff hike is set to take effect on 1 April 2024 for Eskom customers. Coupled with last year's 18.65% increase, this surge translates to a staggering 33.8% surge in electricity costs over the past two years. Municipal electricity tariffs are set to follow suit with regulator-approved increases scheduled for 1 July.

Comparatively, the country recorded headline consumer inflation of 7% in February 2023 and 5.6% in February 2024.

Against this backdrop, LookSee executive head, Marc du Plessis says that households are looking to sustainable solutions to provide meaningful, long-term savings.

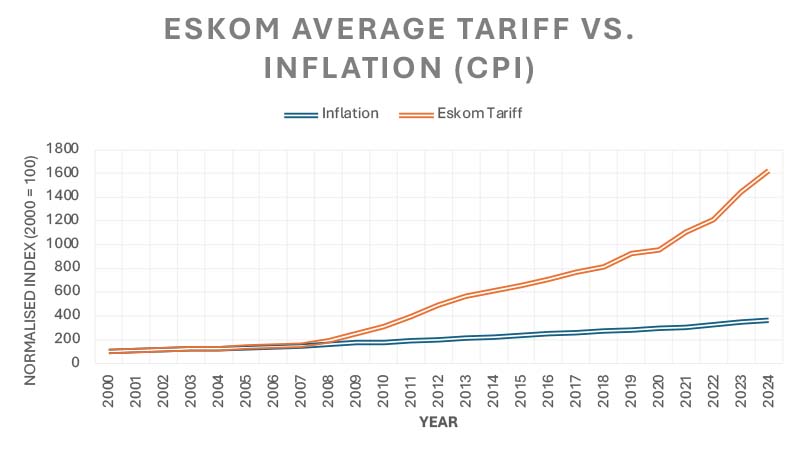

“The last 16 years have seen electricity tariffs increases well above inflation. Households have also had to deal with rising interest rates and, for many, little in the way of positive salary movements. The resulting pressure on household budgets has obviously been significant and families have had to find new ways to tighten the belt.

“Solar solutions – from targeted power interventions to full home installations – are increasingly being seen as ‘must haves’ for households looking to protect themselves from rising electricity prices and ensure long-term savings,” he reveals.

No Eskom relief in sight

A comparison of Eskom’s tariff increases against South Africa’s Consumer Price Inflation (CPI) over the past 24 years provides insight into the increased financial pressure households are finding themselves under.

Statements from Eskom's General Manager of Regulations, Hasha Tlhotlhalemaje, also point out that Eskom is pursuing a “migratory path” towards tariffs that accurately reflect the costs of electricity production.

BusinessTech reports that analysts believe electricity prices need to increase by 40% to 45% to accurately reflect these costs.

Turning to solar for savings

Household adoption of solar power solutions has seen a boom in recent years due to higher levels of loadshedding implemented as Eskom battled to meet growing demand. Today, however, families are seeing the potential of solar in a new light, says du Plessis.

“Our conversations with customers are increasingly about the immediate and long-term savings that solar offers. What is clear is that the difference between the savings on the electricity bill under the new tariffs and the monthly repayment on a solar finance agreement is declining substantially.

“This means that families can use their savings to pay off their solar investment much faster and start benefiting from free electricity from the sun. Imagine what you could do for your family if your electricity bill was 80% to 90% lower? At this point, protection from loadshedding and power outages is seen as a great benefit rather than a primary driver,” he points out.

For households that want to take a more targeted approach to adopting solar power, du Plessis recommends addressing the impact of water heating on the electricity bill.

“The geyser accounts for about 40% of the average household’s electricity bill, so savings in this area can still be considerable,” he says.

LookSee offers conversions of existing electric geysers to get power from solar panels that offer all the benefits of traditional solar geysers (and more) without the drawbacks.

“The advantage of this approach is that we’re only installing regular solar panels and a controller which connects to your existing geyser’s element and thermostat. This means your geyser is left in place where it is protected from weather conditions, you don’t require expensive plumbing work and you get to benefit from the long lifespan of normal solar panels which typically last as long as 25 to 30 years,” he explains.

What’s more, the controller allows for the geyser to maintain a connection to the home’s main electricity supply for backup power during extended periods of cloudy weather.

Saving on solar

Another driver for interest in home solar solutions is the considerable drop in price for components and the introduction of financing options based on government’s Energy Bounce Back Loan Guarantee Scheme.

“There’s no doubt that solar systems are more affordable than ever before particularly as prices have dropped by as much as 30% since last year this time due to the number of components available in the local market,” says du Plessis.

“However, homeowners need to be aware that prices could once again rise once local supply is used up and exchange rates, import taxes and pricing fluctuations come back into play.”

Meanwhile, government’s Energy Bounce Back Loan Guarantee Scheme has enabled banks to offer attractive terms on financing for residential solar installations.

Du Plessis explains: “We were very excited to be the first bank to go to market with a residential offering under this scheme. Our Solar Loan offers personalised interest rates starting at Prime +1% up to a maximum of Prime +2.5% on loans ranging from R3,000 to R300,000. Our customers can choose a repayment term between 12 months and 5 years with the added benefit of no penalties for early settlement.”

And because the electric geyser conversion includes the installation of solar panels, it can be financed with a Solar Loan, adds du Plessis.

Families considering using a Solar Loan to finance an installation should, however, note that National Treasury has declared the offering will only be available to 31 August 2024.

The LookSee Solar Loan offers personalised interest rates capped at Prime +2.5% for loans up to R300 000.